Recently, AI manufacturers such as Microsoft and Google and computing power chip manufacturers such as NVIDIA have frequently added orders for 800G optical modules. The demand for computing power has driven the rapid growth of demand for high-end optical modules, and the industry has broad prospects.

1. Optical module market size

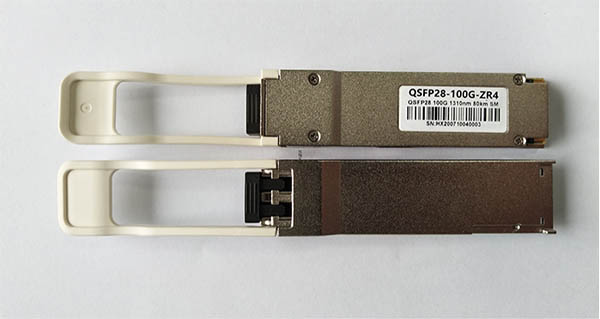

Optical modules are composed of optoelectronic devices, functional circuits and optical interfaces. Optoelectronic devices include transmitting and receiving parts. The global optical module market size in 2022 will be approximately US$9.6 billion, a year-on-year increase of 9.09%. The growth rate of the global optical module market is expected to decline to 3.54% in 2023, and is expected to exceed US$15.6 billion in 2027.

2. Optical module market structure

At present, the global optical modules are mainly datacom optical modules. Datacom optical modules include Ethernet optical modules, connectors, and FibreChannel optical modules, accounting for 67.4% of the total. Telecom optical modules account for 32.6%.

3. Cost proportion of optical modules

In the cost structure of optical modules, optical devices are an important part of the optical module, accounting for the highest proportion of the cost, accounting for 37%, mainly including TOSA, ROSA and the components that constitute TOSA and ROSA, such as TO, wavelength division multiplexer , TO holder, TO cap, isolator, lens, filter and other accessories. In addition, the cost of integrated circuit chips accounts for 22%, the cost of optical chips accounts for 19%, and the cost of structural parts accounts for 11%.

4. Proportion of optical module application fields

In the field of optical module applications, the telecommunications market is the first market for optical communications, mainly including 5G communications, optical fiber access, etc. The construction of communication networks drives the demand for optical communications market; the data communication market is the fastest growing market for optical communications. Mainly including cloud computing, big data, etc., the growth of data traffic and data exchange volume drives market demand.

Data shows that the data communication market accounts for 51% and the telecommunications market accounts for 49%. As the construction demand for downstream 5G networks and data centers will continue to increase, the future market space for optical modules in the telecommunications market and data communication market will be huge.

5. Statistics on the localization rate of optical modules

Data shows that the localization rate of low-end optical modules below 10Gb/s in my country has reached 90%, and the localization rate of 10Gb/s optical modules is 60%. Although my country currently leads the world in the field of optical modules, it relies on imports in the field of optical chips, the core components of optical modules. The localization rate of high-end optical modules and components of 25Gb/s and above is extremely low, only 10%. Optical modules are domestically produced. The process of transformation has a long way to go.

6. Number of optical module patent applications

In recent years, domestic optical module companies have continued to make breakthroughs in key core technologies. Data shows that the number of optical communication patent applications in my country has grown rapidly from 2018 to 2021, increasing from 3,459 to 4,634, with an average annual compound growth rate of 10.2%. The latest data shows that the number of optical communication-related patent applications in my country in 2022 is 3,835.

7.Competitive landscape

In recent years, with the rapid development of the optical communication industry, the competitive landscape of the optical module industry has undergone profound changes, which mainly exhibits two major characteristics: From the perspective of the industry chain, optical module companies continue to engage in mergers and acquisitions, and vertically integrate the industry chain. , industry concentration has further increased; from a regional development perspective, with the economic globalization and the rapid development of the optical communications industry in developing countries such as China, major international optical module manufacturers have gradually shifted their manufacturing bases to China and other countries. With the transfer of developing countries, the R&D capabilities of Chinese companies in optical modules have also been rapidly improved, and they have become an important force in international competition.

Post time: Oct-26-2023